Posted on: December 13, 2024, 02:56h.

Last updated on: December 13, 2024, 04:35h.

The failed All Net Arena project on the north Las Vegas Strip was always an unfunded boondoggle, as Vital Vegas blogger Scott Roeben has trumpeted — alone among Las Vegas media outlets — since at least 2017.

Now, an investor lawsuit alleges that All Net was something much more nefarious — a scam engineered to generate a decade’s worth of income for its founder, former NBA player Jackie Robinson, as well as for his friends and family members.

Kent Limson and TACSIS APC, the California law and accounting firm in which he serves as a partner, filed a racketeering lawsuit on Tuesday against Robinson and his All Net Land Development LLC, the company that collected investments and loans to build the $5 billion NBA arena and resort that, the lawsuit claims, Robinson knew would never materialize.

In addition to the investment, the civil action claims, more than $800 million in short-term loans were collected between August 2014 and December 2019 that were never repaid.

The lawsuit, filed in US District Court in Nevada, seeks damages of more than $6.4 million. That’s triple the amount of actual damages sustained by Limson and TACSIS, which is the penalty prescribed by the RICO (Racketeer Influenced and Corrupt Organizations) Act.

Net Zero

According to the complaint, Robinson, who proposed the project in 2013, personally guaranteed investors repayment through “performance bonds” issued by AGS Assurety LLC. But no bonds were ever purchased with investor money. Instead, all of it was transferred to a Las Vegas LLC named Dribble Dunk, which Robinson controlled.

Dribble Dunk, according to the complaint, regularly transferred a portion of the money to Robinson, his spouse, and friends and family members fronting as “consultants.” These individuals not only received “lush” consultant fees, according to Limson and TACSIS, but also “generous” holiday bonuses.

Another portion of investment funds went to AGS Assurety manager Timothy Arellano, the plaintiffs claim, who “never secured a single bond.”

“Plaintiffs received performance bonds as security for the loans, which plaintiffs would later learn through discovery were fraudulent forgeries,” the lawsuit claims.

According to the suit, the balance of the investment money went to pay All Net Land Development for the rental and/or rights to purchase the 26-acre property. It also paid for the services of attorney Torben Welch of Utah-based Messner Reeves.

Limson and TACSIS claim this scam operated while Robinson knew full well that his All Net project “was facing a huge multimillion-dollar deficit and was ready to collapse any day,” since it had “no serious commitment building loans needed to properly fund the project.”

All the aforementioned people and entities that the lawsuit alleges received All Net investment money were named as defendants, in addition to around 100 others affiliated with All Net.

A similar lawsuit was filed by Limson and TACSIS in February 2020 in the US District Court of Central California. However, that case was dismissed under jurisdictional grounds. Many of the accusations in that case were repeated in the Nevada filing.

After more than a decade of stalling, Robinson was forced to abandon All Net by the Clark County Commission, which voted 7-0 in November 2023 to deny yet another extension of the project’s construction permits when it finally dawned on them that none of the funding promised by Robinson was ever secured.

Tall Net

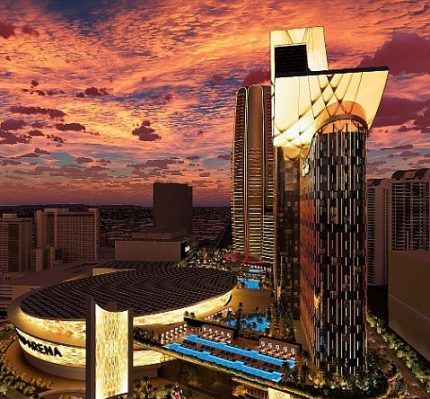

Just five months after All Net was euthanized, another group of developers announced its owns plans to build a multibillion-dollar resort and NBA-ready arena on the same lot.

LVXP claims it will break ground early next year.

This again strikes Vital Vegas — the lone Las Vegas media outlet not just copying and pasting the real-estate group’s ambitious press releases and renderings — as highly suspect.

For one thing, there already is an NBA arena planned for the Las Vegas Strip. Though not yet officially announced, all indications are that it will be built in the current parking lot of the Rio by the Oak View Group (OVG).

Also, LVXP has no history of building arenas, and its principles include:

- CEO James R. Frazure, a former managing director of an international rare-metal mining group

- Chief of Staff Christine Richards, a professional dancer and choreographer

- Chief Construction Officer Nick Tomasino who, as the Senior VP of Construction for the Sphere, managed to let it go more than a billion dollars over budget.

In contrast, OVG is a $500 million company with a track record of building sports facilities. These include the Climate Pledge Arena in Seattle, the UBS Arena on Long Island and Co-Op Live in Manchester, England.

Oh, and OVG is headed up by Tim Leiweke, the former president of live entertainment behemoth AEG, and Irving Azoff, manager of a little rock band called the Eagles.