Posted on: February 14, 2024, 04:27h.

Last updated on: February 14, 2024, 04:35h.

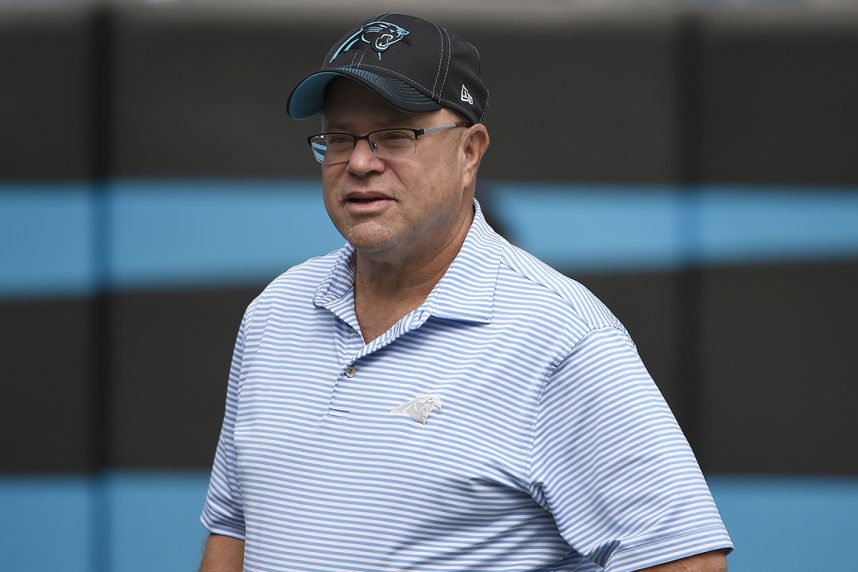

Appaloosa Management, the hedge fund controlled by Carolina Panthers owner David Tepper, increased its stake in Caesars Entertainment (NASDAQ: CZR) in the fourth quarter.

The Harrah’s operator was one of several previously held positions in which Appaloosa boosted its exposure during the last three months of 2024. At the end of last year, the money manager held 2.25 million shares of the casino operator, up from 1.53 million at the end of the third quarter, according to a Form 13F filing with the Securities and Exchange Commission (SEC) on Wednesday.

Form 13F is the filing required by the SEC from money managers who have $100 million in assets or more on the last trading day of any month of the year. Those investors must file 13Fs 45 days following the last day of the year, and 45 days after the end of the first, second, and third quarters.

As of the end of 2023, Caesars is the only casino stock among Appaloosa’s equity investments.

Interesting, Coincidental Timing

As noted above, Appaloosa added to its Caesars investment during the fourth quarter, but that increase wasn’t revealed until today.

In what amounts to interesting, though likely no more than coincidental timing, the hedge fund’s 13F arrived about a week after reports surfaced that the NFL is permitting owners to own up to 5% of sportsbook operators — news that was widely criticized by some zealous fans who believe the league has allowed games to become scripted while doing nothing about subpar officiating.

Caesars runs a slew of retail sportsbooks and it’s one of the more prominent names in the mobile wagering arena, but sports betting’s contributions to the company’s top and bottom lines are dwarfed by its land-based casino operations.

Additionally, with Appaloosa holding just 2.25 million shares of the Flamingo operator, it’s unlikely Tepper and his hedge fund will control 5% of the gaming operator anytime soon. Fellow NFL owners Jerry Jones (Dallas Cowboys) and Robert Kraft (New England Patriots) were early investors in DraftKings (NASDAQ: DKNG), but not to the extent of 5%.

Caesars Still Hedge Fund Favorite

Hedge funds have long been engaged with gaming stocks, and Caesars has frequently been a favorite of those professional market participants.

Based on recent data furnished by Hedge Follow, Tepper’s Appaloosa Management is the eighth-largest hedge fund owner of Caesars equity. Other well-known names on that list include Steve Cohen’s Point72 Asset Management and Ken Griffin’s Citadel.

Cohen, who’s also the owner of the New York Mets, wants to bring a casino hotel to Queens, NY while Griffin opposes similar efforts in South Florida. He moved his firm to Miami from Chicago and believes casinos could be detrimental to South Florida’s thriving economy.