Posted on: November 29, 2024, 01:21h.

Last updated on: November 29, 2024, 01:21h.

Fanatics is making gains in terms of US online sports betting (OSB) market share, indicating that it could be a viable contender in the space over the long-term.

Privately held Fanatics acquired PointsBet US in 2023 in a $225 million all-cash deal, paving the way for the apparel giant’s betting and gaming unit to enter the regulated North American online sports wagering space. At the time of that deal, PointsBet’s US market share was scant and the company wasn’t profitable, underscoring why the Australian parent sold the business.

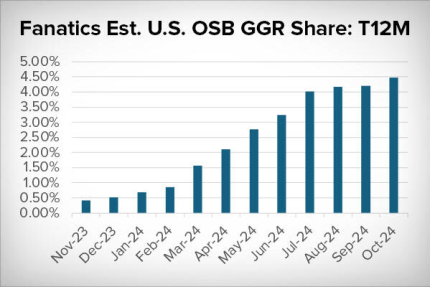

Since then, Fanatics has made significant market share gains, rising to 4.8% of the US OSB space at the end of October, up from less than half a percent in November 2023, according to Eilers & Krejcik Gaming (EKG).

The research firm noted Fanatics is making strides in the US OSB realm by focusing on the basics of customer acquisition and retention.

Technology, VIP Focus Helping Fanatics OSB Ascent

Fanatics’ emphasis on technology and attracting and keeping the right customers — namely high-end bettors — are among the reasons the operator is making market share gains.

The Fanatics OSB app was up to third in our 2H24 testing report, with major improvements in its promotional offerings, as well as its cash-out and SGP availability,” noted EKG. “That means more customers sticking around longer, but we also suspect Fanatics is getting better at profiling and keeping the right customers around longer, with VIPs clearly a focus.”

Recently, there’s been evidence of Fanatics making some inroads in the US OSB industry, including in New York. That’s the largest state by sports wagering GGR and handle. In September, Fanatics ranked fifth in terms of New York online sports betting market share, trailing FanDuel, DraftKings, BetMGM, and Caesars Sportsbook.

Fanatics’ strides in New York are impressive not only because that’s the largest OSB market in the country, but also because Chairman and CEO Michael Rubin said two years ago that the company would likely pass on the state because of its onerous 51% tax on sports wagering.

Long Way to Go, But Fanatics Progress Evident

The current lay of the land in US OSB is a duopoly controlled by FanDuel and DraftKings with nearly all other competitors struggling to reach double-digit market share. That’s a tough mountain to climb, but Fanatics is making strides thanks in part to effective promotional spending.

“With customer values thus trending in the right direction, Fanatics seems more willing to spend on acquisition, with bonusing also climbing in recent months and peaking at 100% of GGR in October in reported states,” adds EKG. “Tie it all together and Fanatics—along with bet365—looks to be one of the challenger brands capable of making a dent in the U.S. duopoly.”

Fanatics offers mobile sports betting in 22 states and Washington, DC. That figure is likely to increase by at least one next year with the addition of Missouri.