Posted on: November 8, 2024, 04:27h.

Last updated on: November 8, 2024, 04:27h.

For decades, the landscape of gaming equities was largely dominated by casino stocks and, to a lesser extent, suppliers. In recent years, that’s changed with significant contributions from online sports betting and real estate companies.

When it comes to publicly traded casino landlords, the universe consists of two names — VICI Properties (NYSE: VICI) and Gaming and Leisure Properties (NASDAQ: GLPI). Those real estate investment trusts (REITs) are spin-offs of casino operators. VICI was separated from Caesars Entertainment (NASDAQ: CZR) while Gaming and Leisure was spun out of Penn Entertainment (NASDAQ: PENN).

Their business model is appealing to many investors. Neither REIT is reliant on casino visitation or bad luck at the tables by players. Rather, they collect rent and that rent has to be paid tenants (gaming companies) risk significant damage to their credit ratings. Additionally, tenants — not GLPI or VICI — are responsible for enhancements and maintenance at the properties.

In 2023 alone, VICI’s revenue surged by 35.8%, largely thanks to its aggressive acquisition strategy,” noted Drew Anderson, product analyst at VanEck. “They’re not just snapping up casinos either — VICI has diversified its revenue streams beyond traditional gaming activities, scooping up assets like Bowlero bowling centers and the Chelsea Piers complex in New York.”

VICI is the largest owner of Las Vegas Strip casino real estate and owns the property assets of iconic venues such as Caesars Palace, MGM Grand, and the Venetian.

Other Benefits with Casino Real Estate Stocks

Gaming and Leisure and VICI offer investors other potential benefits. The broader universe of REITs is often favored by market participants when inflation rises, as it did in 2022 and 2023, because landlords often bake inflation escalators into tenant contracts and that’s true of gaming REITs.

Additionally, REITs of all stripes are interest rate-sensitive, meaning the stocks often move inversely of rates. Following a cut of 50 basis points in September, the Federal Reserve lowered rates by 25 basis points earlier this week. Then there is the long-term leases gaming companies sign with the likes of GLPI and VICI. That makes forecasting future earnings and cash flow easier for analysts and investors.

“These long-term leases ensure that the tenants (the casino operators) are responsible for virtually all expenses, from taxes to maintenance. Rent escalation clauses are also baked into lease agreements, which means GLPI and VICI sit back and collect steady rent checks, giving them a predictable revenue stream that’s less volatile than the ups and downs of daily gaming activity,” added Anderson.

Both VICI and Gaming and Leisure have outperformed Caesars and Penn since being separated from those casino companies.

Online Sports Betting a Growth Leader

Since the 2018 Supreme Court ruling on the Professional and Amateur Sports Protection Act (PASPA), 39 states and Washington, DC have approved some form of sports wagering, driving interest in stocks such as DraftKings (NASDAQ: DKNG) and FanDuel parent Flutter Entertainment (NYSE: FLUT).

Today, those two companies hold a duopoly in the US sports betting space, which has exploded thanks to many states permitting mobile and online wagering, meaning visits to physical sports books aren’t required.

“The internet has fundamentally reshaped gambling, and the old stereotype of gamblers traveling to casinos is becoming increasingly outdated,” observed Anderson. “Sports media outlets cover the betting odds of every event. With the rapid expansion of online gaming and sports betting, the action has moved from the neon-lit Strip to the palm of your hand.”

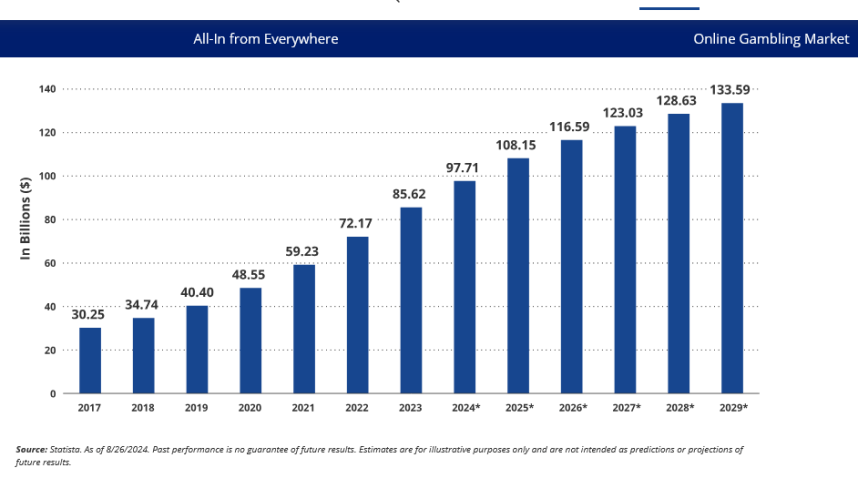

As the chart above confirms, online wagering is experiencing growth and that is expected to continue, particularly if more states approve iGaming in addition to sports betting.