Posted on: October 29, 2024, 08:43h.

Last updated on: October 29, 2024, 08:45h.

Jim Chanos, one of the most accomplished short sellers in the history of US financial markets, has a bone to pick with election betting platforms and his personal political leanings might be why.

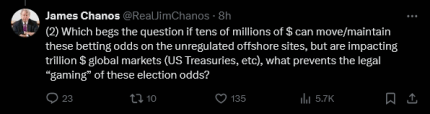

Citing data from Kalshi, which earlier today indicated it had taken in $94.26 million on the US presidential election contest, Chanos took to X (formerly Twitter) to opine that it’s concerning that small amounts of money can move election wagering markets, thus potentially affecting multi-trillion dollar financial markets. Around the time of the Chanos tweet, Kalshi showed former President Donald Trump with a 63% to 37% over Vice President Kamala Harris.

While some platforms that permit betting on US elections are located outside of this country, that’s not true of New York-based Kalshi. That company and rival Predictit, which is based in Washington, DC, provide investors with an avenue to buy event contracts on elections. Those instruments are classified as derivatives and as such, Kalshi and Predictit are regulated by the Commodities and Futures Trading Commission (CFTC).

Chanos Could Be Ruffled by Betting Market Findings

Chanos doesn’t hide his political leanings. His X feed includes criticism of Elon Musk’s comments on illegal immigration, similarly jaded comments directed at Rep. Byron Donalds (R-FL) — a Black Republican — implications that Trump’s recent event at Madison Square Garden catered to fascism as well as an unfounded claim that Russia interferes with US elections.

Chanos supported President Biden in during the 2020 election cycle and with one exception, all of his contributions to political candidates and parties listed on OpenSecrets went to Democrats.

In 2017, he said that a some of his most successful short sales occurred when Republicans were in the White House, including the collapses of Enron, Tyco and WorldCom. While it’s accurate that the collapses of those companies occurred while Republican President George W. Bush was in office, the accounting scandal that triggered Enron’s demise was built over years in which Democrat Bill Clinton was in the Oval Office and some experts believe it was lax leadership at the Securities and Exchange Commission (SEC) during his presidency that led to massive damage incurred by Enron investors.

In separate 2017 — Trump’s first year as president — comments, Chanos warned that all was not well with the US economy. However, GDP growth for that year was 2.3% compared to 1.5% in 2016. The S&P 500 gained 20.8% in 2017.

Chanos Known in Gaming Circles

Chanos is well-known to investors that follow casino gaming and sports wagering stocks. In 2021, the Kynikos Associates founder shorted DraftKings (NASDAQ: DKNG), touching prompting rebuke from co-founder and CEO Jason Robins.

That was the right call as that stock and others like it proceeded to swoon in 2021. Chanos changed his tune on sports wagering stocks last year, saying they merited consideration as long ideas due to the lack of proficiency among US bettors.

Chanos also had a short position in Wynn Resorts (NASDAQ: WYNN) in 2021. He retired last year.