Posted on: October 25, 2024, 04:20h.

Last updated on: October 25, 2024, 04:20h.

Shares of Boyd Gaming (NYSE: BYD) rallied Friday, a day after the casino operator delivered third-quarter results — a report that highlighted growth opportunities in Las Vegas and Norfolk, Va.

The stock closed higher by 7.85% on volume that was nearly triple the daily average, ascending to a fresh 52-week high, after the operator waxed bullish on its plans for the Cadence Crossing Casino in suburban Las Vegas and a partnership with a Native American tribe to run a new gaming venue in Norfolk. Analysts took note with Stifel analyst Steven Wieczynski raising his price target on Boyd stock to $74 from $67.

BYD is slowly starting to stick out from their peer group given continued healthy/stable trends in their core Las Vegas locals market coupled now with a decent-sized long-term growth project (Norfolk, Va.) that will come online in stages starting next year,” observed the analyst.

He said that with the help of the aforementioned projects and “a pristine balance sheet” relative to rivals, previously dour sentiment on the stock could start turning for the better.

New Casinos Support Case for Boyd Stock

In its home market of Las Vegas, Boyd tussles with Red Rock Resorts (NASDAQ: RRR) to command the bulk of play from locals and with that rival planning enhancements in the Valley, Boyd needs to respond.

Some of that response includes Cadence Crossing, which will replace Jokers Wild Casino in Henderson — a property affected by the coronavirus pandemic. Boyd originally planned to rebuild the venue using the Jokers Wild name, but it’s taking the Cadence Crossing name to reflect ties to a new nearby master-planned community.

In Virginia, Boyd will work with the Pamunkey Indian Tribe, which recently won voter approval to build a new gaming venue along the Elizabeth River. Wieczynski said that project is attractive on multiple levels, including the point that it diminishes the likelihood of Boyd shopping for established casino assets.

“Moving onto the Norfolk project, we think the casino development represents a compelling opportunity for proven gaming operators to enter an underserved, high-quality market without having to pursue/execute large-scale M&A,” added the Stifel analyst. “We also think this $750M project decreases the likelihood that BYD will go out and buy a portfolio of land-based assets, which truth be told, makes us breathe a sigh of relief.”

Other Boyd Las Vegas Casinos Could Help, Too

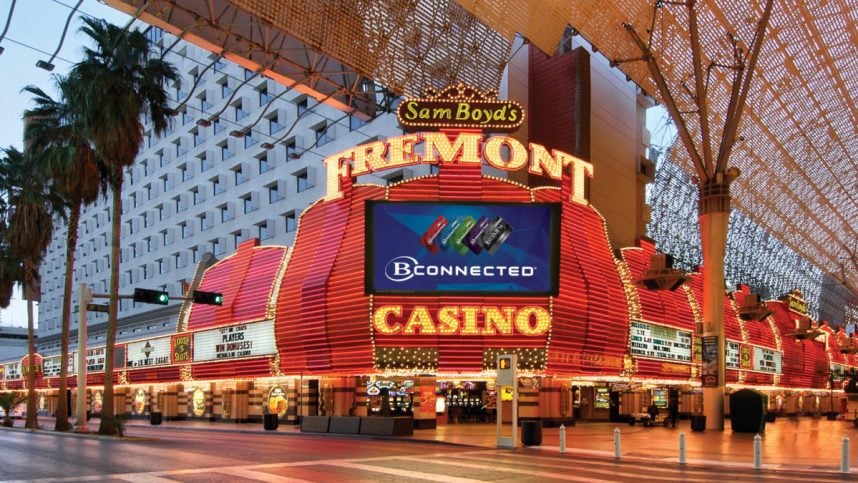

During the third quarter, Boyd’s downtown Las Vegas segment, where it’s the largest operator, performed well, but the Orleans and the Gold Coast were hindered by what the company described as “competitive pressures.”

Those headwinds could be in the form of smaller independent operators boosting promotional activity at casinos that compete with Gold Coast and the Orleans as well as Red Rock’s Durango potentially pilfering some business from those venues as well as the Suncoast.

Boyd recently opened a new high-tech sportsbook at Suncoast and Wieczynski believes the opportunity is there for the operator to rejuvenate overall activity at that casino hotel.

“However, looking into 2025, we believe the setup for BYD could become extremely compelling relative to the broader regional gaming landscape,” concluded the analyst. “If the company can execute a similar playbook at Suncoast as they implemented at the Fremont, we believe the Las Vegas locals segment could be poised to not only normalize but deliver growth despite oppressive promotional conditions.”