Posted on: October 20, 2024, 04:00h.

Last updated on: October 19, 2024, 10:03h.

Fanatics, which is one of the newest players on the US sports betting stage, is making strides in New York — the country’s largest market by handle.

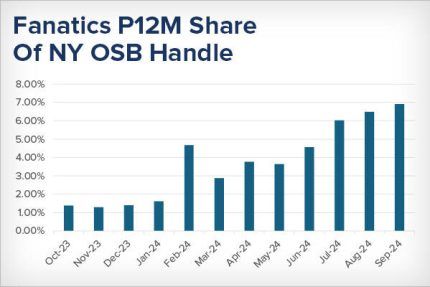

Privately held Fanatics acquired PointsBet US in 2023 in a $225 million all-cash deal, providing the buyer with an entry into regulated sports betting. A year ago, PointsBet had just over 1% market share in New York based on handle, but that percentage has surged significantly in recent months.

The Fanatics brand actually launched in March 2024, taking over from PointsBet and has since grown handle share from under 3% to just over 7% in the seven months since,” according to Eilers & Krejcik Gaming (EKG).

In September, Fanatics ranked fifth in terms of New York online sports betting market share, trailing FanDuel, DraftKings, BetMGM, and Caesars Sportsbook.

Other Signs of Progress for Fanatics in New York

Ranking fifth in New York might not sound aw-inspiring, but there are other signs of progress by Fanatics in the fourth-largest state.

“Regardless, the general upward trend in New York and increasing marketing spend looks to be part of a national uptick,” added EKG. “Fanatics was fourth in online sports betting application download share through six weeks of NFL action, per Sensor Tower data, behind only FanDuel, DraftKings, and Hard Rock.”

The comments on mobile app downloads pertain to the US as whole, signaling Fanatics is making incremental progress in the hyper-competitive US sports wagering space — one dominated by FanDuel and DraftKings. Fanatics offers mobile sports betting in 22 states and Washington, DC.

The operator’s upside trajectory in New York comes after Chairman and CEO Michael Rubin said two years ago that the company would likely take a pass on the state due to its 51% sports betting tax, which is the highest in the country.

Promo Spending Helping Fanatics in New York

One of the reasons Fanatics is making headway in New York is because it’s proving generous when it comes to promotional spending.

“The operator has been aggressive around bonusing in recent weeks, including a 10-day free bet challenge with up to $1,000 in bonus bets for new customers,” observed EKG.

Sportsbook operators’ promotional spending often trends higher during football season because the sport is the most wagered on in the US. Still, promotional expenditures have trended downward over the past several years as operators have focused more on profitability.

Fanatics’ spending on that front in New York is pertinent and could be pay dividends in terms of customer acquisition there because some rivals have pared marketing expenditures in the state as a way of dealing with the high taxes.