Posted on: July 2, 2024, 08:51h.

Last updated on: July 2, 2024, 08:51h.

Chicago is sitting on ticking time bomb of underfund public pension obligations, underscoring the need to haul in revenue from Bally’s planned permanent casino hotel — a project some local politicians and residents view as on life support.

The city’s 2023 annual financial report, certified by accounting firm Deloitte & Touche, indicates unfunded public pension liabilities surged 5.2% last year to $37.2 billion from $35.4 billion. Not only does that mark the second straight year in which Chicago’s pension obligations increased by more than 5%, but it’s a discouraging because stocks — one of the asset classes to which pension plans are most heavily allocated –rallied last year with the S&P 500 gaining 26.2%.

When Illinois Governor J.B. Pritzker (D) signed Senate Bill 516 into 2019 authorizing a single integrated resort in Chicago, it was hoped that such a venue would provide much needed to support to the city’s ailing public employee retirement plans. In order for related revenue to be maximized, a permanent casino resort must be constructed.

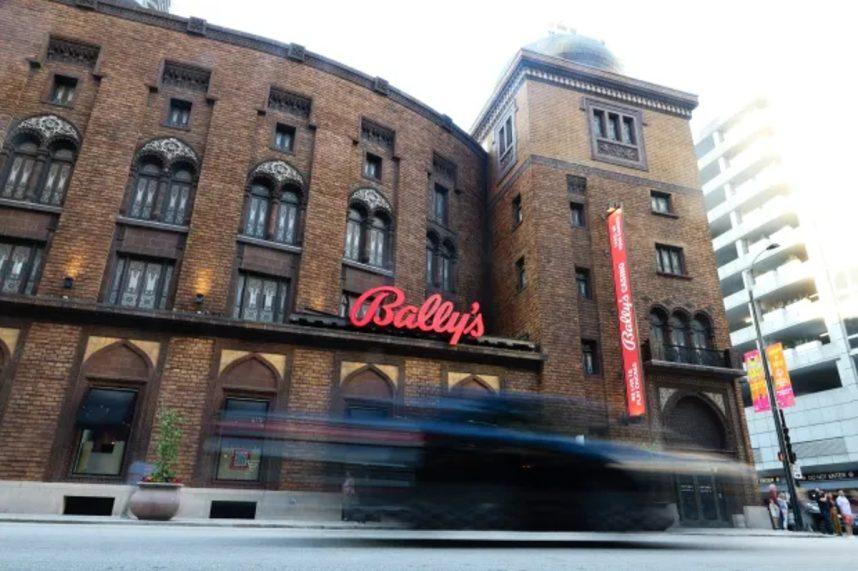

Currently, Bally’s is operating a temporary gaming venue at Medinah Temple in the River North area of the city and it hasn’t received all necessary permitting to begin demolition at the Freedom Center — the proposed cite of the permanent casino. Still, the gaming company believes it will open the casino hotel in the third quarter of 2026.

Chicago Pensions Need Bally’s Help ASAP

As reported by the Chicago Sun-Times, funding levels for Chicago firefighters and police pensions are below 22% while municipal employees fund is 22.2% with the laborers pension looking strong by comparison at 38.55%.

In Illinois, there is some evidence of new casinos bolstering local pension schemes, but that’s in smaller jurisdictions with significantly less in the way of public employee retirement obligations. Chicago is a different ballgame and Moody’s Investors Service warned in 2020 that while Bally’s casino when fully ramped could assist in shoring up Chicago’s pension funding ratios, the gaming venue would be far from a cure all on that front.

Should any of the city’s pension plans go bankrupt, those obligations would be shifted to taxpayers in an already heavily taxed state. Additionally, there’s not much Illinois can do in terms of reducing benefits pledge to retired public workers. Such efforts have been attempted in other states with courts consistently ruling that any cut to public retiree benefits must be made up for in other areas.

States with large public pension obligations are also facing demographic headwinds. Namely, some employees work for 25 to 30 years, but with rising life expectancies, some live long enough that they end up receiving more in retirement benefits than they paid into the system.

Bally’s Struggles Alarm Bells for Chicago Pensions

Potentially compounding Chicago’s pension woes is that Bally’s is facing financing issues of its own. The regional gaming company needs to come up with $800 million in financing to make the Chicago venue a reality, but its junk credit ratings make procuring that capital expensive and difficult.

Recently Mayor Brandon Johnson (D) was reserved in his expectations for Bally’s Chicago making it across the finish line. Others are more blunt in their assessments.

Civic Federation President Joe Ferguson told the Sun-Times that Bally’s permanent venue in the city is “hanging by a thread” and growing “more remote by the day.” If that assessment is accurate, pressure intensifies for locating avenues through which public pensions can be propped up.