Posted on: February 29, 2024, 01:35h.

Last updated on: February 29, 2024, 01:48h.

Boyd Gaming (NYSE: BYD) announced Thursday that it’s increasing its quarterly dividend by 6.3% to 17 cents a share from 16 cents.

The payout hike implies a forward dividend yield of 1.06%, up from the current level of 0.99%, based on the stock’s current price. Shares of Boyd were higher by almost 1.50% on the news in midday trading. The gaming name is up 3.66% year to date.

The dividend is payable April 15, 2024, to shareholders of record at the close of business on March 15, 2024,” according to a statement issued by the Las Vegas-based regional casino operator.

At the end of 2024, Boyd Gaming had cash on hand of $304.3 million, indicating it has the financial resources with which to support shareholder rewards. The operator’s outstanding debt stood at $2.9 billion at the end of last year.

Boyd Extends Favorable Dividend Trajectory

It’s been about two years since Boyd reinstated its quarterly payout following a suspension used as a cost-conserving move during the worst days of the coronavirus pandemic.

Since that reinstatement, the Orleans operator has boosted its dividend twice — once by 6.66% in February 2023, and the increase announced today. That could be a sign the gaming company has the potential to be a credible dividend growth stock.

Boyd has also shown commitment to other shareholder rewards. In the fourth quarter, Boyd repurchased $100 million in shares of its common stock, leaving it with $326 million from a previously announced share buyback plan.

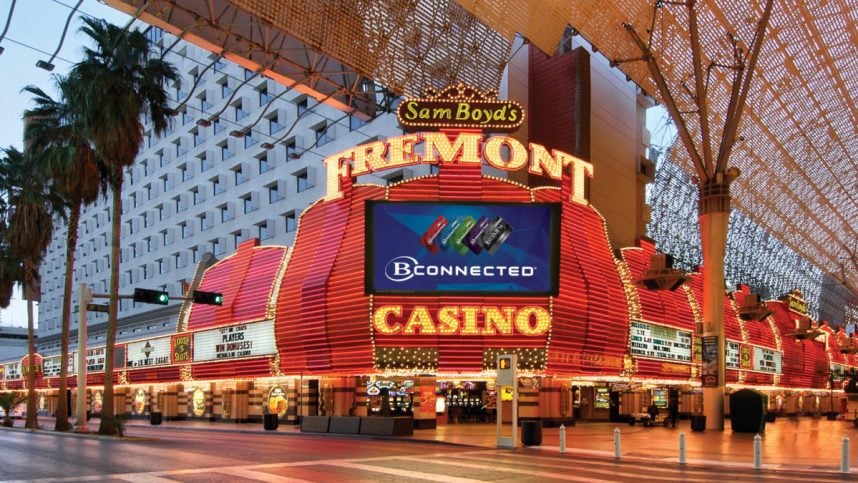

Boyd runs 10 gaming venues in its home market, including Aliante, California, Cannery, Fremont, Gold Coast, Jokers Wild, Main Street Station, Sam’s Town, Suncoast, and The Orleans. It also operates regional casinos in Illinois, Indiana, Iowa, Kansas, Louisiana, Mississippi, Missouri, Ohio and Pennsylvania.

Other Bullish Dividend News in Gaming Industry

The dividend increase announced by Boyd on Thursday is the latest in a string of encouraging payout news from the gaming industry. Earlier this week, Gaming and Leisure Properties (NASDAQ: GLPI), one of the largest casino landlords, said it’s raising its quarterly dividend to 76 cents per share from 73 cents, extending a lengthy run of dividend increases.

On February 7, Red Rock Resorts (NASDAQ: RRR) announced a special dividend of $1 per share, its third since November 2021. That’s in addition to the casino operator’s regular quarterly distribution.

Among publicly traded land-based casino operators, the companies that don’t currently pay quarterly cash dividends are Caesars Entertainment (NASDAQ: CZR), Century Casinos (NASDAQ: CNTY), Golden Entertainment (NASDAQ: GDEN), and Penn Entertainment (NASDAQ: GDEN).